The domestic supply chain for electric vehicles has been under the spotlight as a result of news of the agreement reached by Senators Schumer and Manchin to extend and modify the incentives for electric automobiles. In addition to extending EV subsidies, their proposal does so in a way that forces manufacturers to buy an ever-increasing percentage of battery materials and components locally or from trade partners of the United States.

This focus on sourcing is in line with one of the main suggestions in my upcoming book Charged: A History of Batteries and Lessons for a Clean Energy Future. In order to achieve a clean energy transition, the United States must immediately implement measures that will increase the sustainability and security of the material supply. This objective will be attained in part by the administrative action taken by the Biden administration and the legislation that Congress is now debating.

However, concerns are already being voiced about whether the sourcing criteria could undermine the effectiveness of the updated electric vehicle incentives if more information about them becomes available. Once implemented, in order to receive the full $7500 tax credit, 40% of the value of the key materials and 50% of the battery’s components must match the sourcing requirements, and those percentages increase yearly starting in 2024. How many manufacturers will be able to meet these demands in the near future is an unanswered question.

But each week, cleantech headlines are flooded with information about new battery gigafactories, electric vehicle assembly plants, recycling facilities, and proposed mines. The Biden administration’s initiatives to boost domestic manufacturing through the Defense Production Act and the Advanced Vehicle Manufacturing Loan Program have boosted this activity. The government just last week approved $2.5 billion in loan backing for GM’s partnership with LG to produce batteries in Ohio, Tennessee, and Michigan.

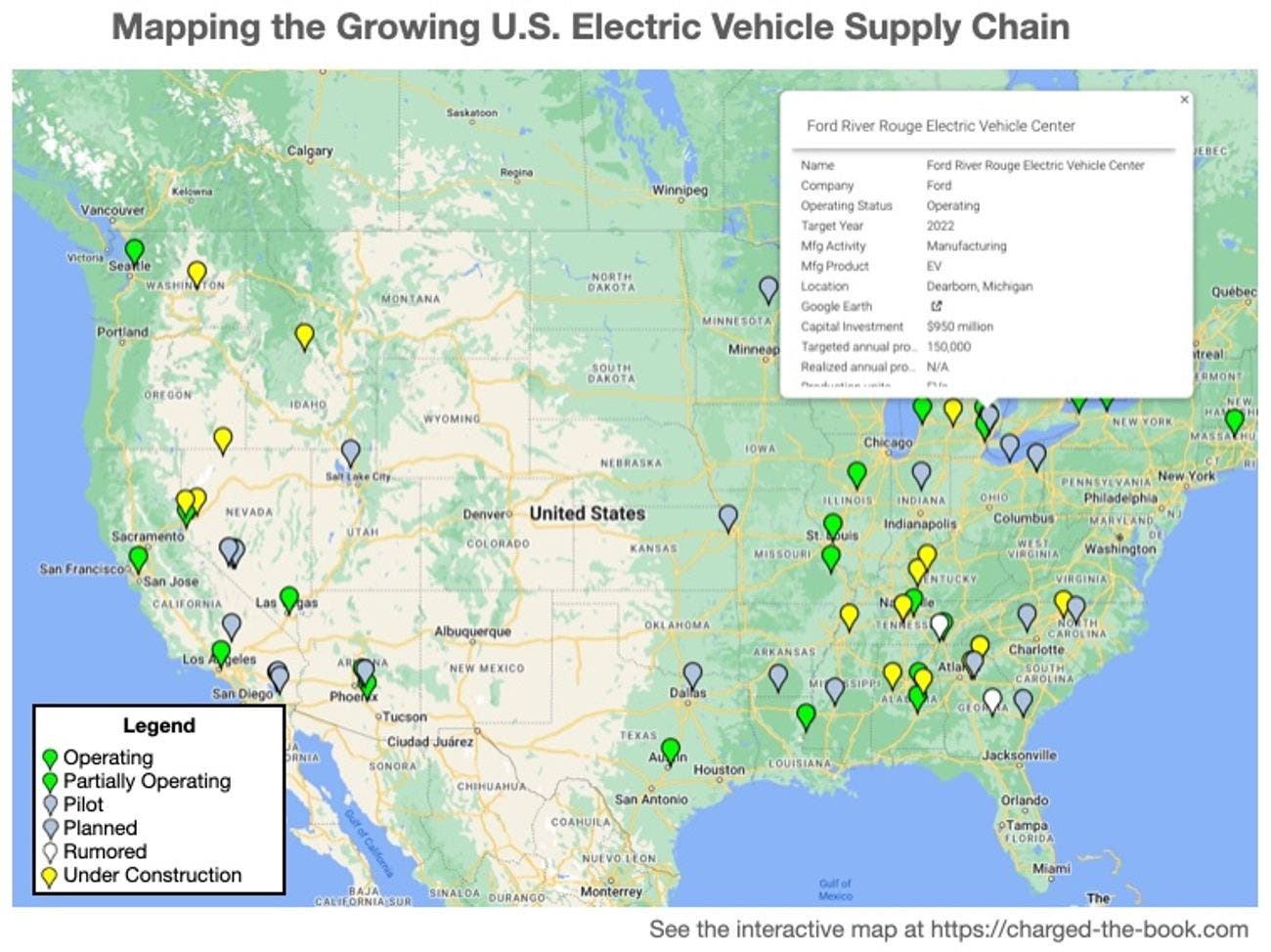

Does this surge of interest represent a domestic supply chain for electric vehicles? How much of these new initiatives are merely plans? How many projects are currently being built? Which facilities are currently in use? What location are they in? How many positions could be added? We developed an interactive dashboard with a map to trace the supply chain for electric vehicles in the USA in order to aid with these inquiries.

The dashboard is the result of research we carried out this summer at Wellesley College, using data gathered from official documents, business news releases, media publications about the industry, and regulatory filings. It is still under construction. We intend to keep adding to the dashboard in order to correct any errors or omissions in the information provided, as well as to follow the expansion of the electric car supply chain and include major U.S. trading partners (starting with Canada and Mexico).

We are now monitoring 77 locations in the domestic EV supply chain, which includes mining operations, operations for refining minerals, factories for making battery cells and components, facilities for assembling electric vehicles, and recycling operations. 17 of the sites are currently in use, 10 are operational but still being built, 17 are still under construction, and other sites are being planned or piloted.

It won’t come as a surprise to learn the dashboard’s main lesson: The vital elements required for batteries are only mined or refined at a few locations in the United States (we are tracking lithium, cobalt, nickel, and graphite). Although a dozen more sites are in the planning stages, manufacturers face significant difficulties in meeting the requirements for domestic material sourcing in order to meet the proposed EV incentives due to the difficulties in obtaining permits for mining and refining operations and putting them into production.

What is certain is the large upstream investments being made in the production of battery cells and components. Based on those that have published capacity targets, eight sites are now in production, and ten more are under development, with a combined capacity to employ 32,550 people and generate at least 700 GWh of batteries annually.

The planned EV incentives include components supplied from U.S. fair trade allies, which is fantastic news. South Korea, Australia, Chile, Mexico, Canada, and the other nations on that list will be crucial in assisting firms in meeting the new sourcing standards. The geography of the electric car supply chain will change, however, if the EV sourcing provisions are implemented. We’ll continue to update our dashboard to monitor how it develops in the US.

The production of clean energy minerals will need to be greatly increased if we are to make the transition to a clean energy future. This is the subject of my editorial in the @ScienceMagazine special climate change edition. 1/4 https://t.co/ajffL8KzWC

Jay Turner June 24, 2022 (@ jay turner)

Professor of environmental studies at Wellesley College and writer of the upcoming book Charged: A History of Batteries and Lessons for a Clean Energy Future, James Morton Turner (August 2022). Visit https://charged-the-book.com to explore the interactive EV supply chain dashboard and discover more information about Charged. At @_jay_turner , Turner tweets. Wellesley College first-year student Arzy Abliadzhyieva.

by Arzy Abliadzhyieva and James Morton Turner

Do you value the unique reporting and cleantech news coverage on CleanTechnica? Consider becoming an Patreon patron or a CleanTechnica member, supporter, technician, or ambassador. Don’t miss a cleantech story, will ya? Register for daily news updates from CleanTechnica by email. Or follow us on Google News Want to advertise with CleanTechnica, send us a tip, or propose a speaker for our podcast CleanTech Talk? You can reach us here.